Business Expense Substantiation & Tax Implications (BEX)

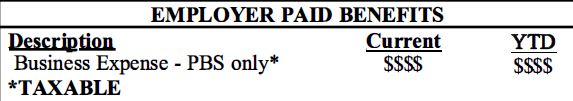

The University of Colorado's Accountable Plan, under IRS regulations requires that the University report as taxable income any business expense incurred by an employee and not substantiated within 90 days of the transaction date or within 90 days of the trip end date. Substantiation refers to an employee submitting an expense report in Concur, documenting the business purpose of the transaction, and providing required receipts / supporting documentation, and reimbursing the University (if appropriate), within the required timeframe.

This policy applies to transactions that are processed through:

- Procurement Card (p-card)

- Travel Card

- Airfare (booked through Christopherson Business Travel or Concur)

- Out-of-Pocket / Reimbursement

- Cash Advances